Residential Market Japan

Residential Real Estate in Japan – Market Review for 2021

The Japanese residential property market impressed in the second pandemic year of 2021 with continued resilience. Anti-virus restrictions, border closures, and increased work from home had relatively little impact on new investments and rental income. Institutional addresses from home and abroad continued to invest steadily, accepting rising prices. Nevertheless, yields remained at an attractive level relative to the office sector.

Economy and politics

The Japanese economy weathered 2021 comparatively well thanks to strong fiscal and monetary support. Despite three COVID-19 infection waves, GDP grew by 1.7% in real terms, according to a World Bank estimate. The shortage of semiconductors and other parts affected Japanese exports and industrial production rather little by international standards. The government lifted the “state of emergency”, which primarily restricted restaurant opening hours and the serving of alcohol, at the end of September. Afterwards, private capital expenditure and consumption picked up.

The Nikkei 225 and Topix stock indices closed the year at their highest level since 1990, and bank lending stabilised at an elevated level after the sharp increase in 2020. According to Bank of Japan data, the total outstanding loan amount to the non-government real estate sector of currently 112 trillion yen (€862 billion, as of 30.9.21) did not decrease at any time during the pandemic. On the contrary, according to data from the market researcher Nikkei, loans have grown for the 33rd quarter in a row since autumn 2013.

The yield on the 10-year government bond (JGB) moved up less than in Western countries from August onwards. Although the Bank of Japan bought fewer government bonds and exchange-traded index funds, it maintained its extremely loose monetary policy. The widening yield spread over US government bonds depreciated the yen against the dollar.

The political environment for investors remained stable. The changeover from Prime Minister Yoshihide Suga to Fumio Kishida in September went smoothly. Kishida won the general election at the end of October by a comfortable margin and then launched record extra spending to overcome the pandemic damage.

The population shrank by an estimated almost 440,000 to 125.8 million in 2021 due to the low birth rate. But the metropolitan areas hardly suffered. The population of 8.9 million in Tokyo’s 23 wards did decrease by a net 41,000 from the previous year. But almost two-thirds of them were foreigners because only a few new visas were issued for workers and students. The upward trend seems to be unbroken – from 2010-2021 the population grew by a total of 9.6%.

New investments and demand

According to Kensho calculations, residential real estate recorded net new investments of €10.8 billion. In both Corona years combined, it was €37.6 billion. The assets of privately-held REITs rose from 22.5 to 23.4 trillion yen (€180 billion). The assets of listed residential REITs grew from 20.2 to 20.7 trillion yen (€160 billion). The entry of new players signals a continued upward trend. Allianz Real Estate, for example, announced in December that it would invest $2 billion in Japanese residential real estate with two major partners. Equity commitments amount already reached to $750 million. The institutional investors’ demand remains strong including overseas investors, whose transaction share of residential properties had climbed from zero in 2012 to almost 40% in 2020.

The stronger demand does not necessarily cause price jumps. After all, the supply of flats will grow, as some office space is to be converted into flats due to the increase in work from home. For example, the developer of the tallest skyscraper “Torch Tower” near Tokyo Station has recently announced plans for 50 luxury flats on the upper floors with monthly rents of 1-5 million yen. According to the forecast of the Real Estate Economic Institute, 14,000 new flats will enter the market in the 23 wards of Tokyo in 2022, an increase of 1.4% compared to last year. According to this forecast, 34,000 units will be offered in the Tokyo metropolitan area (+4.6%).

Housing prices

Acclimatisation to the pandemic and consistent investor demand triggered some significant price recovery in 2021. The average price of a new flat in the Tokyo metropolitan area (January to November) rose by 8.0% year-on-year, reaching 64.78 million yen, the highest level since 1990 when the so-called “bubble economy” ended. At the same time, the supply stock in Greater Tokyo fell for the 24th consecutive month.

Likewise, demand for second-hand housing increased strongly. One example: 5,546 bids were submitted for 631 ex-athlete flats in the Olympic Village with areas of 61-123 m2 at sales prices of 50-292 million yen (€384,000-2.2 million). Because of the almost ninefold oversubscription, the developer had to award the bids by lot.

The resale price of a 70-square-metre flat in the Tokyo metropolitan area reached a historic high of 41.14 million yen (€318,000) in June, according to data platform REINS, up 17% from June 2020. The average selling price per square metre for a second-hand flat in Greater Tokyo was 807,200 yen/m2 in November. This was 6.4% higher than a year earlier and marked the 19th consecutive monthly increase.

Investment yields

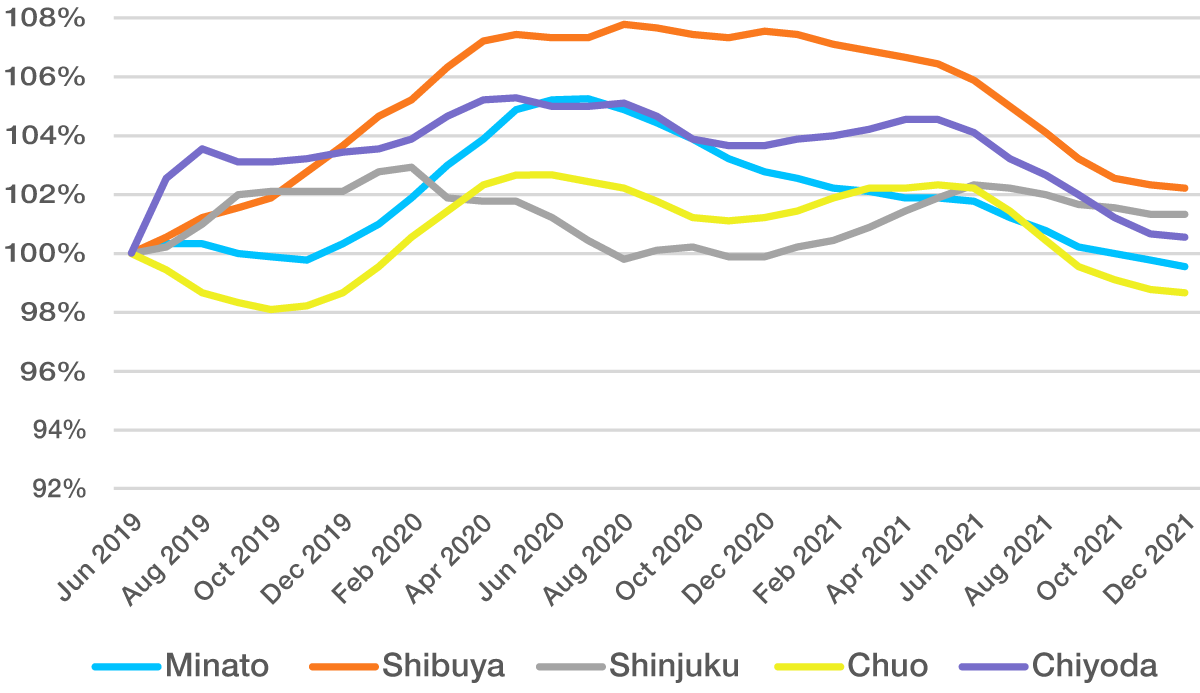

Investors had to pay for the higher prices of residential properties with lower yields. The capitalisation rate of residential J-REITs fell from 4.30% at the end of 2020 to 4.20% in July 2021, for Tokyo yields reduced from 4.02% to 3.94%. (By comparison, office yields remained at 4.0% nationwide and 3.75% in Tokyo as vacancy rates rose). Some investors shifted to Osaka, thereby narrowing the yield differential to Tokyo from 0.50 to 0.25 points. Other investors focused on properties in the previously neglected suburbs of the capital Tokyo. Rental prices of small flats for singles (under 30 m2) and couples (30-50 m2) continued their downward trend since early 2020. Meanwhile, rents for family flats (70 m2 and above) climbed, because some families and also couples are moving into larger units due to increased work from home. Likewise, for residential units with more than one studio, the rental prices in the outskirts of Tokyo benefit compared to central locations, as the following picture shows:

Changes in rent by ward

Change in 6-month Moving Average (Units Other than Studios) in Tokyo (City)

Change in 6-month Moving Average (Units Other than Studios) in Greater Tokyo

Summary

Despite high macroeconomic volatility and the upheavals caused by the pandemic, investments in residential real estate in Japan in 2021 once again proved to be sustainable and resilient assets. The corresponding increase of interest from domestic and foreign institutional investors added to pressure on the capitalisation rate. For new investments, investors should pay attention to the diverging rental trends and choose to build a diversified residential portfolio as a viable strategy.